Darvas Trading System Metastock For Mac

Equis, I would like to see in your next release, to have included Darvas Boxes automatically plotted on the charts also to have the expert advisor include to have the following Expert Advsor with commentary for the following Darvas style trading:. Darvas Classic. Darvas Modern.

Darvas Breakout Also to have a system test also a Exploration on the above three Darvas Style Trading. On either the Expert Commentary and/or Exploration have the entry price to entry the trade also include the stop loss price and exit price. Would like to get a feedback from the Equis staff, on my request to see in the next MetaStock release. Sincerely Nasdaqtrader. Having read some of the Darvas stuff and been exposed to some of the Darvas 'experts' flogging their wares on the net, I am more confused now than ever before about exactly what is the Darvas trading system! So many people espouse they have the Darvas secrets etc and have their implementations of the Darvas system that the proper, authentic Darvas trading system and methods have been obfuscated.

Do a Google for Darvas boxes written for metastock and see some of the many implementations, all are different, which one(s) are correct? Although it is an easy thing to request the various methodologies, without have the proper definitions they are impossible to implement. If you have the true definitions of the methodology or even just a method that you would like in MS, considerate of copyright and other legal issues, post them and we shall see what can be done to code them. Why not contract someone to implement these for you?

(Advertising my own services here and the other contract coders too!) Hope this helps. My textbooks define obfuscate: to make obscure, to be evasive, unclear, or confusing. Although Patrick has found one example of its use, I have been confronted with and using the term extensively during my cyber-forensics studies for the past eighteen months or so, as when wrong-doers often use various obfuscation techniques to impede/thwart investigation. It was also a term commonly used in my previous employment of nearly eighteen years, so, although you imply I found the word at another forum, your post is inaccurate.

Also, you still have not offered any proof that your code is the 'truest definition' of the original Darvas method. Noone has implied your code is confused or evasive, but as your code doesn't implement the Darvas rules as written by Darvas himself it is erroneous, unless you have another definition of the Darvas method as described Darvas himself, anything else is just another interpretation that changes the original (which was the point of my first post in this thread). Please provide evidence of your claims of the 'truest definition', or edit your post because it is misleading. A very brief search found three different implementations that all produce different results, from each other and from the code posted at the link above. The code at the links below all start plotting a new box high three bars after the new period high (including the high bar in the count).

E statement, but as you made the comment, you should back it up with some facts. If you cannot, your post is misleading. Wabbit :D Just some more information for interest of others: Nice description of one person's implementation of their understanding of the Darvas system. A very brief search found three different implementations that all produce different results, from each other and from the code posted at the link above. The code at the links below all start plotting a new box high three bars after the new period high (including the high bar in the count). The code in those three links would qualify as the some of the worst examples of MetaStock coding I've seen - and I've seen.

In your haste to prove me 'obfuscating', you seem to have missed the fact that my version of the Darvas code is a complete box and signals entity, all without the performance-robbing PREV function or any black-box external calls. Another issue that seems to have gone way over your head, is the plain fact that breakout-type strategies are no longer profitable in modern markets. I'm sure Darvas found this out after he hung his dancing scensoreds back in the 70's.

Wabbit, the rest of this thread is yours,as I'm not interested in proving any point - different versions of the Darvas Box code can be found, and it's up to the individual to decide on each version's worth. Your have still have failed to provide proof that your implementation is the 'truest definition' of the Darvas method as requested. It has nothing to do with which is the 'better' code or which is the fastest code.

You made the assertion that your code is the 'truest' implementation which means that you have compared your implementation versus the original Darvas recipe, and with every other implementation of the Darvas methodology and have evidence to suppoprt your claim. If you have not done this, then your claim is misleading. It is irrelevant that you believe one code does more or less than another code or that the methodology itself is no longer relevant in todays markets, you claim the truest implementation of the Darvas method and have not posted any facts to back up that statement. If you make a claim, you must provide evidence to support that claim. Your have still have failed to provide proof that your implementation is the 'truest definition' of the Darvas method as requested.

You can go on requesting all you like, but I'm not the least interested in spending scarce resources (time) to prove anything to someone who obviously does not understand neither trading nor the markets. I'll leave it up to the more knowledgeable traders/MetaStock users to make up their own mind about what may be a good or poor MetaStock implementation of the Darvas Box. ' Breakeout-type strategies are no longer profitable in modern markets.' Jose my friend, this statement makes me very sad. All my various explorations are based on just this assumption.

Not saying they are any better or worse for it. But doesn't the following idea still apply? If a stockprice makes several successive attempts at a line of resistance & finally breaks through, it'll quite likely continue on up.

Darvas had his own way of defining that line & also the boxes, I don't want to enter into that debate. In the case of Darvas if I remember correctly, it was not so much a line as a series of equal high's over a period of 200 days or something like that. Why in your opinion, wouldn't that work any more?

Darvas Trading System Metastock For Mac

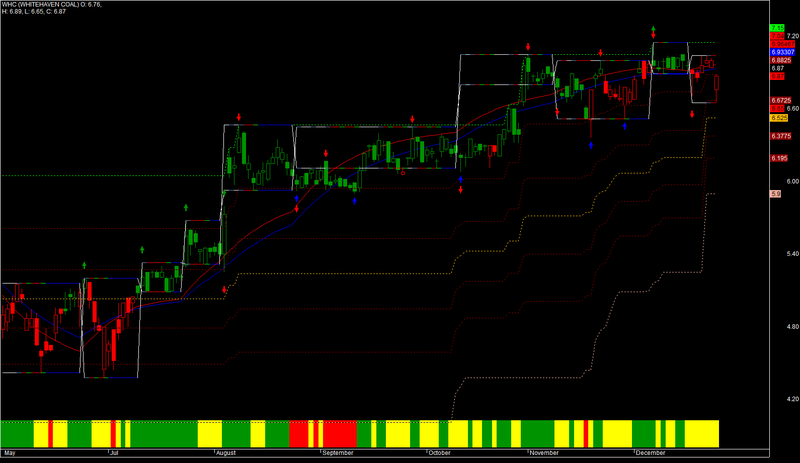

Best regards. If one might just add a good example - breaking not so much thru a line but thru a succession of more or less equal highs - HIL has a good clean Darvas-line at 612, followed by a breakout on 23/8 to 629. Which led to a nice upward continuation. The 'boxes' would have to be the bits between, preceding the breakout.

ANN is another one, their pattern is more erratic, but might still be classed as a Darvas. Have just made the breakout to $13.10 will have to watch what happens next. Likewise CSM.

No doubt there are various interpretations of the perfect Darvas pattern.